- Cents Invest Newsletter

- Posts

- TESLA SHARES RALLY ON EARNINGS

TESLA SHARES RALLY ON EARNINGS

Week of 1/27/23

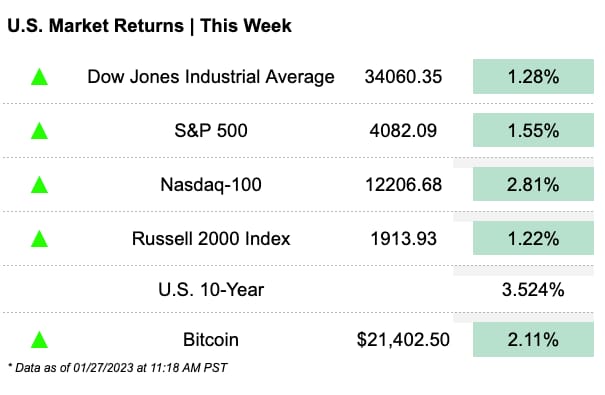

It was a busy week for earnings and economic data, with a number of major companies reporting their quarterly results. The market saw a lot of volatility as investors digested the news, but one of the biggest stories of the week was the rally in Tesla's stock price. The electric vehicle maker reported strong earnings which sent the stock soaring by more than 20%. Overall, it was a week that demonstrated the power of earnings and economic data to drive market movements, and investors will want to keep a close eye on upcoming reports as we move through earnings season. The Fed meets again next weeks and investors are expecting a 0.25 percentage point rate hike. Also be on the lookout for Apple and Amazon earnings.

Cents Invest Club members, remember to scroll down to the bottom to see all of the earnings posts that we made this week including MSFT, ALLY, JNJ, VLO, BA, DOW, and a Portfolio update from our lead analyst Leo.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

Howard Marks is worth $2.2 billion.

His secret to investing?

These 7 principles:

— Codie Sanchez (@Codie_Sanchez)

2:34 PM • Jan 21, 2023

Tech Layoffs; Bad Economy or Bad Planning?

— Market Rebellion (@MarketRebels)

12:30 AM • Jan 24, 2023

The housing market has never been this unaffordable

— Market Rebellion (@MarketRebels)

7:33 PM • Jan 26, 2023

NEW FROM US:

Adani Group – How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History

(1/x)

— Hindenburg Research (@HindenburgRes)

2:45 AM • Jan 25, 2023

Trends In Focus

Much of the competitive strength of FIS comes from its strong brand and wide range of solutions offered. The global nature of the company exposes it to growth opportunities but risks as well. It operates in three separate sub-industries (previously mentioned) which diversifies revenue. I’ll briefly summarize the qualitative aspects of the business: Banking solutions is the largest business segment reporting 46% of total revenue with a 8% growth rate in 2021. Much of this growth was organic. Imagine everything your bank does from processing payments, to credit and loans, to client management and processing items including networks and transfers. These core processing elements are integral to bank function. To read the full thesis and get a model click here.

Results -

Revenue $24.3B vs. $24.1B est. (BEAT)

EPS $1.19 vs. $1.13 est. (BEAT)

Gross Margin 23.8% vs. 25.6% est. (MISS)

EBITDA. 5.4B vs. $5.4B est. (BEAT)

EBTIDA Margin 22.2% vs. 22.4% est. (MISS)

Summary -

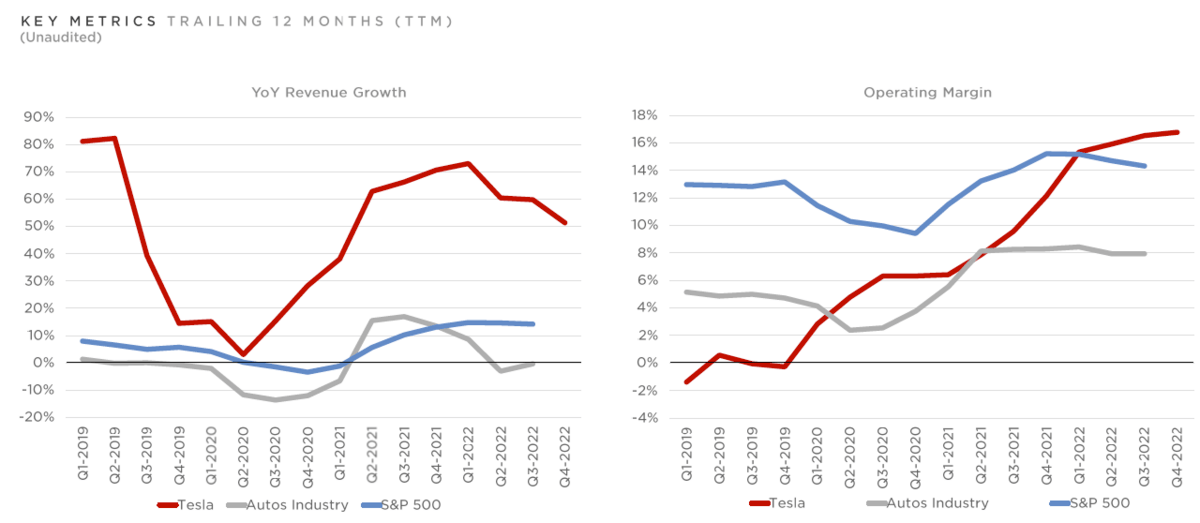

Tesla had a fantastic year in 2022, delivering over 1.3 million cars and achieving a 17% operating margin, the highest among any volume carmaker, and generated $12.5 billion in net income and $7.5 billion in free cash flow. Despite the challenges of forced shutdowns, high interest rates, and delivery difficulties, the Tesla team was able to achieve these records. Demand for Tesla cars is strong, with orders currently at almost twice the rate of production. Tesla is making progress on cost control and the cost of production in Berlin and Austin is dropping as the production increases. Autopilot has been deployed to 400,000 customers in North America, and the company is seeing improvement in safety statistics.Production rate of 4680 cells reached 1,000 cars a week at the end of last year, and the company plans to increase capacity by another 100 gigawatt-hours. Energy storage also saw record growth and is continuing to accelerate. Tesla's goal is to accelerate progress towards a sustainable energy future for humanity. Tesla is taking a view that they want to keep making and selling as many cars as they can, while retaining the industry's best operating margins. The company is making progress on cost reduction and improving overhead efficiency, which is the most effective method to retain strength in operating margins. Read more here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)