- Cents Invest Newsletter

- Posts

- Silicon Valley Bank Fails: What This Means for Tech Startups and the Banking Sector

Silicon Valley Bank Fails: What This Means for Tech Startups and the Banking Sector

Insights into the Causes, Implications, and Lessons from the Closure of a Leading Deposit Bank for Early-Stage Tech Companies

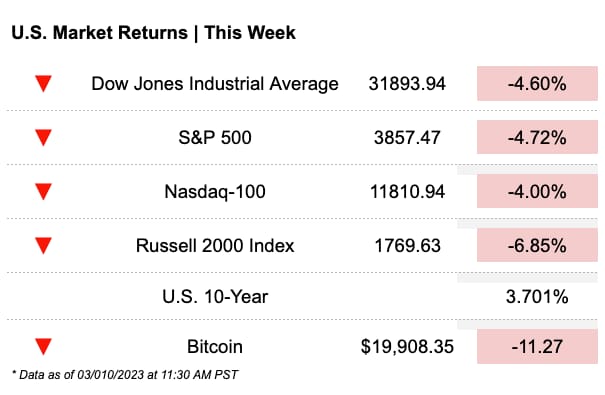

😨 Unfortunately, we don't have good news at all. The latest data on unemployment shows a rise to 3.6%. In addition, Silicon Valley Bank's recent failure after being closed by regulators has sent shockwaves through the banking sector, especially given its focus on early-stage tech startups. All of this has caused all major markets to be down over 4%, causing widespread panic among investors. Let's take a closer look at what's been happening and what it could mean for the future.

⚠️ Cents Invest Club members make sure you are checking the portal announcements next week as we will be rolling out a return of a ROI Club favorite feature, two word product and both of the first letters start with a B. We are also finishing developments on a modeling tool for the portal. Stay tuned....

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

The tech funding bubble is bursting

— 1 Main Capital (@1MainCapital)

12:25 PM • Mar 9, 2023

Trends In Focus

IAS works to verify ad campaigns for advertisers and make sure that the campaign is getting exposed to real people (not bots) and track the program to give more information to publishers and advertisers to make sure that their advertising program is giving the best ROI as possible.

Q4 earnings were exceptionally good (as the price would indicate) they grew the topline revenue 15% YoY and for the full fiscal year, revenues were up and importantly for the Full year, they have greatly improved their GAAP profitability from a loss of 52 million last year to an income of $15M this year. Their Cash from operations also went from 63M - 72M.

More importantly, the company is guiding for 15% revenue growth while increasing ebitda margins in 2023. This is while they are showing a 4% decline in gross profit which management thinks will only be a temporary thing and margins will return back to ~82% in the following years.

Overall, a great quarter and guide, right now I think the multiples are a little extended (19X PE and 25X FCF)

To read more about IAS click here.

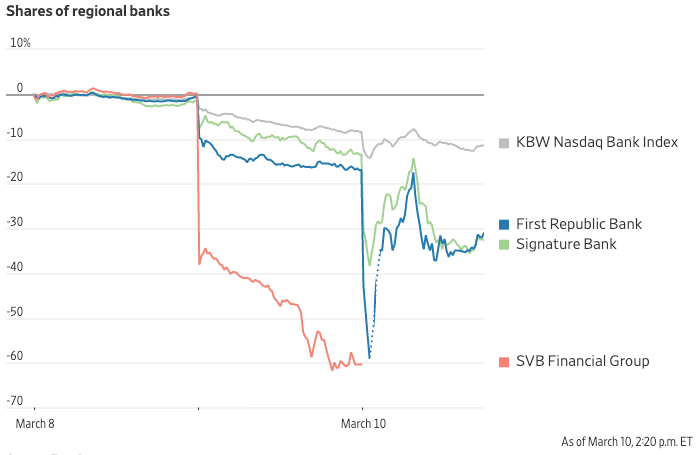

Yesterday & Today, there was a sell-off in financials and risk assets due to the market thinking that rates will be higher for longer, hurting financial companies like KKR and BX more, and risk assets getting a larger discount. However, upon further review, it's not the entire financial market collapsing again, like in 2008, but rather a bank run on Silicon Valley Bank (SIVB), which focused on giving deposits to early stage tech startups in Silicon Valley.

SIVB had a significant increase in total assets under management, going from roughly $71BN in the year ended 2019 to $211B by the end of 2021. However, tech startups, who were depositing the money and getting loans from SIVB, have had a difficult year in 2022, with liquidity drying up. This, combined with the bankruptcy filing of crypto-bank Silvergate, which was related to many tech startups, caused panic to anyone holding deposits with SIVB.

While some are saying that this is 2008 all over again, and the financial system is breaking, it's still early to tell. The VC space is blowing up, and liquidity is getting drained out of the system, causing banks that were swimming naked with the VC companies to suffer. However, if there is a systemic problem that arises, it could affect the global economy. Nonetheless, this potential sell-off could present some attractive equities, but it's crucial to pay attention to what's happening in the banking sector.

To read the full in depth review click here.

Cents Invest Club

Interesting Posts

Streams and Videos

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

🔵 Cents Invest Portal

🔵 Analyst Portfolios

🔵 Weekly Private ICOM Streams with the Team

🔵 Write-ups, Models, Notes, & More

🔵 Finance Training (DCFs, Comparable Analysis)

Disclosure: This post and its attachments are not financial advice. Might buy or sell any securities without disclosures. Please see full disclaimer here - https://centsinvest.com/spaces/9331277/page