- Cents Invest Newsletter

- Posts

- RETAIL SALES FALL AND TREASURY RALLY INTENSIFIES 👀

RETAIL SALES FALL AND TREASURY RALLY INTENSIFIES 👀

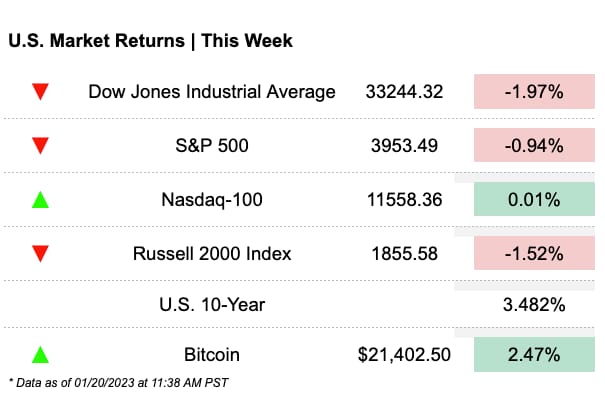

Week of 1/20/23

Goldman Sachs reported a drop in profit due to a lack of deal-making activity. US retail sales also fell 1.1%, and there have been signs of slowing growth in the economy. Despite this, jobless claims have decreased and the US government is taking measures to avoid default. Additionally, existing home sales have decreased and Netflix has reported its earnings.

Many of you have been clamoring for Justin to shave his head despite Money Talks being done with. We think that it should be for the Club instead, so Justin's agreed to shave his head at 4,000 members! By helping us reach our member goal of 4000 subscribers, you'll also be supporting our mission to empower people about stock investing.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE!

What You Need to Know

Headlines

On Twitter

Venture capital return dispersion will soon break into negative territory for the bottom quartile

2022 will likely be a negative return year for venture

Finally, both private equity and venture exits are down significantly because IPOs have practically disappeared

— Marcelino Pantoja (@marcepntoja)

12:01 AM • Jan 16, 2023

A basket of the most shorted stocks surged 15.7% last week

The most violent junk stock rally since the spring of 2020

— Julian Klymochko (@JulianKlymochko)

4:49 PM • Jan 17, 2023

Amazingly of the 256 thematic ETFs, the #1 flow-getter of past 12mo is $ARKK with about $1.8b. So while they've been bypassed on the active ETF front by the big dogs' flow-a-thon, they still bfd in the thematic category.

— Eric Balchunas (@EricBalchunas)

2:18 PM • Jan 18, 2023

$NFLX Q4 FY22 Income Statement

— Market Rebellion (@MarketRebels)

3:50 PM • Jan 20, 2023

Trends In Focus

George Kurtz (CEO of CrowdStrike) tweeted on 1/17/23 that Crowdstrike has poached two executives from SentinelOne - their primary competitor in the SMB space. https://twitter.com/George_Kurtz/status/1615384721957191680

The two executives were the Chief Marketing Officer and Chief Product Officer for SentinelOne. Crowdstrike is currently up 4.8% on this news while S is down .75%

If SentinelOne executives are leaving to join their competitor, they are potentially seeing something in the space that says they think Crowdstrike's product or their place within the market are far superior to SentinelOne, this also could just be Crowdstrike utilizing their Balance Sheet to pay more to poach the executives. Read more here.

Bonds are trading up this week off the backs of weaker than expected PPI data. What does this mean? The slowdown is fast, faster than the talking heads realize. As we've discussed in the livestreams the data often looked upon for clarity on market conditions is at time subpar at best. Lagging is a better word for it. I wish it were so easy to look at a number and draw a conclusion, it yet again shows that the nuances of the numbers are extremely important to draw our conclusions. Housing will show a lag, this is certain. Don't believe me? Hers is an Article from back in December (https://www.realtrends.com/articles/zillow-data-shows-highest-rent-decline-in-7-years/) and the trend is not slowing down.

Sentiment is tied to the FED action, no question about that, regardless of actual affects. From the flow front, there is a more direct measure via non bank institutions. Read more here.

Cents Invest Club

Interesting Posts

Streams and Videos

[THERAPY]*

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)