- Cents Invest Newsletter

- Posts

- Rate Hikes & Big Tech Earnings

Rate Hikes & Big Tech Earnings

A look at META's earnings and all of the investing news from a packed week

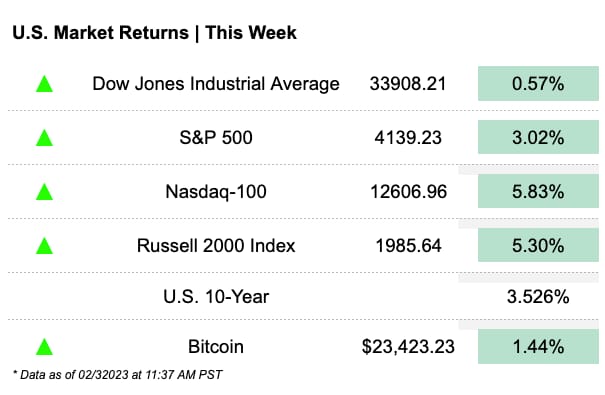

It was a busy and eventful week in the markets, with plenty of headlines that had an impact on the economy and your portfolios. The Federal Reserve made headlines by slowing its tightening cycle, and there were several important earnings releases from some of the biggest names in tech, including Amazon, Google, and Apple. Additionally, the latest employment numbers were also released, providing further insight into the state of the economy. With so much going on, it can be difficult to keep up with everything and make informed investment decisions. That's where we come in. So let's dive into the latest market developments.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

One more rate hike and we have extreme greed 😂

— Sven Henrich (@NorthmanTrader)

4:47 PM • Jan 27, 2023

BREAKING: OpenAi has released tool to help tell when text is written by AI.

— unusual_whales (@unusual_whales)

6:35 PM • Jan 31, 2023

10 Baggers over the last decade in the US that are still small caps

Can they do it again?

H/t @marketplunger1 & @ded@dede_eyesanp

— Brad Kaellner - Stock Compounder (@bkaellner)

8:36 PM • Jan 30, 2023

It‘s all positioning. Everybody was bearish and underweight equities/tech into the year.

— Sheep of Wall Street (@Biohazard3737)

9:41 PM • Feb 1, 2023

Trends In Focus

Our analyst Fabio called out Meta back in October. Fabio had a clear vision of the company's potential as a cash cow business trading at a low multiple, with the added potential of metaverse B2B solutions that are sure to surprise the market. He also acknowledged the popular "Ready Player 1" comparisons, but encouraged everyone to focus on the real value and potential of the company. We're pleased to report that our analyst's analysis was spot on and Meta's shares have already risen by 25% and announced a $40B buyback. If you're interested in seeing his latest thoughts on Meta, we've attached a video where he provides an update following the recent price move.

Fourth-Quarter 2022 Financial Results Summary

Consolidated net sales of $2,652.3 million, an increase of 14.0%.

Organic, constant currency net sales increased 10.7%.

The impact of acquisitions on net sales was a 3.6-point benefit while foreign currency exchange was a 0.3-point headwind.

Reported net income of $396.3 million, or $1.92 per share-diluted, an increase of 18.5%.

Adjusted earnings per share-diluted of $2.02, an increase of 19.5%.

Takeaways:

This was an excellent report, and highlights the strength of Hershey's brands, and validates its acquisition strategy and pricing strategies. Volumes and price were both up, in contrast with many staples brands that are seeing declining volumes. Acquisitions in salty snacks should continue to drive growth - but even the core chocolate/candy business is showing strong demand.

Valuation:

Hershey trades at roughly 26x NTM earnings and 18x NTM EV/EBITDA. This is roughly in line with its 5-year averages. FCF yield is around 3%, on the lower end of its historical range. In the last twelve months Return on Capital was 25.6% and Return on Equity was 56.5%. Although excellent, these figures have been down over the past few years vs. the longer term averages as they work through acquisitions. .

Read the full post here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)