- Cents Invest Newsletter

- Posts

- Market Volatility, Square Earnings, and REITs

Market Volatility, Square Earnings, and REITs

Navigating the Market's Ups and Downs, Analyzing Square's Performance, and Assessing the State of REITs.

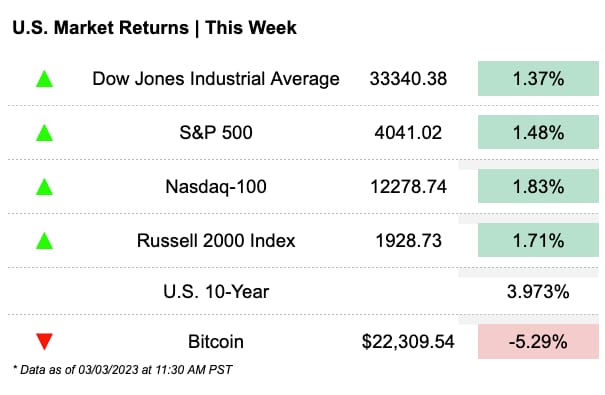

It has been a rollercoaster week for the markets, with a slight decline in the beginning of the week, followed by a quick recovery in just two days. The volatility has left investors on the edge, trying to figure out the direction of the market in the coming days.

In this weeks edition, we will take a closer look at some of the major events that have impacted the market this week, including TSLA investor day and CRM earnings. We will also take a deep dive into the SQ earnings report, which has caught the attention of many investors.

Furthermore, we will examine the current state of real estate investment trusts (REITs) and the outlook for the sector in the coming months. With the continued uncertainty in the market, it's essential to stay informed and make informed investment decisions.

We hope you find this newsletter informative and helpful as you navigate the ever-changing investing landscape. As always, we welcome your feedback and suggestions for future topics.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

As stock pickers you hold big winners three ways:

1.) Active Coffee Can - take sell decision out of your strategy ie @DavidGFool / also VC approach

2.) Passive Coffee Can - Not caring / small position set and forget

3.) Conviction Investing - knowing what you own at all times

— Ian Cassel (@iancassel)

3:52 PM • Feb 26, 2023

1/ Just finished sifting through the Q4 hedge fund letters.

Here are 10 investment pitches that piqued my interest

👇— Dalius - Special Situation Investments (@InvestSpecial)

10:44 AM • Feb 28, 2023

A soft landing has never actually occurred in the US after this much monetary tightening.

Each time the Fed has increased the Federal Funds Rate by 460 bps +, a spike in unemployment and recession ensued.

$SPY $QQQ

— David Marlin (@Marlin_Capital)

11:13 PM • Mar 1, 2023

It is NOT a coincidence that we bounced from the anchored VWAP from October lows!

Note from the weekend:

Beautiful $SPY 🔥

— Tradytics (@Tradytics)

6:54 PM • Mar 3, 2023

Trends In Focus

- Transaction Earnings up 12%

- Cash App showed strong growth

- Position in POS systems remains strong.

With SQ you want to be paying attention to a couple key factors. Transaction volume were in line with expectations from retail sales being actually quite strong. Crypto purchases also came in strong as we see somewhat of a resurgence of interest. (Not where it was though)

Valuation on SQ seems fair at these levels.

RE is showing continued weakness in light of projections on real interest rates. The price of investment instruments like REITs are more closely tied to projections on the REAL rate of interest. It is my belief off the back of a terrible 2022 for REITs and a somewhat poor beginning 2023, it will be a decent time to accumulate your favorites (if you have any) this year. Some sectors are hit harder than others and deservedly so. Not all properties are created equal and will perform differently in a slowdown. Typically for example, in this environment I would except relative stability in Cell towers and apartments.

REITs as a whole have paused most of their aggressive acquisitions. a crowd favorite Realty Income $O is projected to have soft growth year in light again of growing capital costs. You have plenty of entities that are trading at large discounts to the current market value of the underlying real estate. Keep in mind the value of the properties may in fact come down and those estimated prices exist in an environment of low liquidity and little deals.

To see what area of REITs club members are interested in click here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

🔵 Cents Invest Portal

🔵 Analyst Portfolios

🔵 Weekly Private ICOM Streams with the Team

🔵 Write-ups, Models, Notes, & More

🔵 Finance Training (DCFs, Comparable Analysis)

Disclosure: This post and its attachments are not financial advice. Might buy or sell any securities without disclosures. Please see full disclaimer here - https://centsinvest.com/spaces/9331277/page