- Cents Invest Newsletter

- Posts

- The Market Rollercoaster: Consumer Spending Surge

The Market Rollercoaster: Consumer Spending Surge

Riding the Waves of Change in the Financial and Technological Landscapes

Today we'll be covering some major news that's been making headlines lately, including the proposed merger between ATVI and MSFT, as well as the exciting work on TWLO.

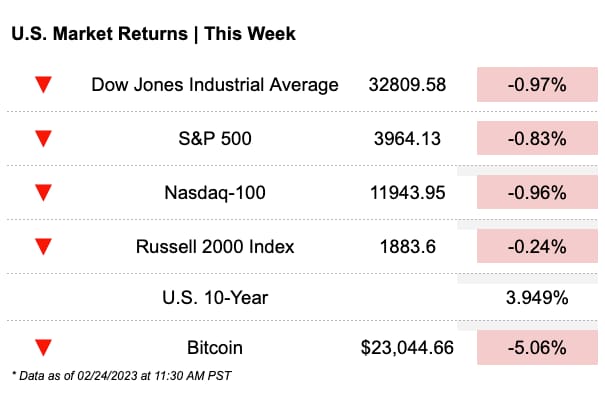

But first, we have some interesting developments to share with you regarding consumer spending and the stock market. Despite economic uncertainty, consumer spending jumped in January. Investors grew increasingly worried about rising inflation and the potential impact it could have on the economy. As a result, we've seen stocks fall this week with many investors closely monitoring the situation to see how it will play out in the months ahead.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

CTAs have a whole lot of selling to do if markets start to roll over.

— 1 Main Capital (@1MainCapital)

2:10 PM • Feb 6, 2023

$HOOD would be such a compelling M&A target for the largest brokers at the right price.

Clear UI upgrade.

Large influx of younger users.

Cash rich balance sheet.

Am I wrong?

— Brad Freeman (@StockMarketNerd)

4:56 PM • Feb 22, 2023

Youngest CEOs of Fortune 500 Companies

— Market Rebellion (@MarketRebels)

1:30 AM • Feb 23, 2023

Aside from the economic turmoil during the March 2020 Covid Pandemic, the S&P 500 PEG Ratio has never been higher (since 1985).

$AAPL $NVDA $TSLA $MSFT http

— David Marlin (@Marlin_Capital)

4:01 PM • Feb 23, 2023

Trends In Focus

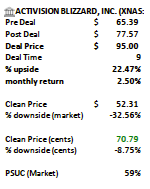

The Microsoft and Activision merger, announced in January 2022, is a significant deal that brings together two major players in the gaming industry. Under the terms of the agreement, Microsoft will acquire Activision Blizzard, the parent company of popular gaming franchises such as Call of Duty, World of Warcraft, and Candy Crush, for $68.7 billion. However, the merger also faces regulatory scrutiny, with concerns raised about potential antitrust issues and the impact on competition in the gaming market.

The deal (if successful) offers around 22% upside. We estimate the market is implying a 60% probability the merger is successful. If not, it appears the underlying business is still valuable. To see the full model please click here.

They have a lot of the infrastructure. They have strong API language models in place and have had it for a long time. Now with all the rage and hype behind Chat GPT idk if that will affect the sentiment around this stock. Looking at the stock price, we are at below 2020 lows. The firm is aiming for profitability in the near future. Looking at outlook they are guiding down.

Some issue I perceive here is the business investment in some services or value added components might be muted. Coming out of a recession in B2B spending the company can continue to expand more/reaccelerate growth. Market likely already pricing that in to some extent. As of late company is really pushing SBC, nearly doubling the share count in the last 5 years. But the operations are growing in excess of that.

Read the full conversation here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)

Disclosure: This post and its attachments are not financial advice. Might buy or sell any securities without disclosures. Please see full disclaimer here - https://centsinvest.com/spaces/9331277/page