- Cents Invest Newsletter

- Posts

- JPMorgan's Rescue Efforts, Falling Home Prices, and Morgan Stanley's Resilience

JPMorgan's Rescue Efforts, Falling Home Prices, and Morgan Stanley's Resilience

Investor Opportunities, Dividends & Buybacks, and Tech Titans Defying Market Trends

🚀 In this week's newsletter, we delve into the latest market insights 📈, covering JPMorgan's efforts to stabilize First Republic Bank 🏦, the first drop in home prices 🏠 in 11 years, and the Fed's rate hike amidst banking stress 💸. We also highlight the resilience of Morgan Stanley 💪, Grupo Aeroportuario del Pacífico's dividend and buyback proposal 💰, and how mega-cap tech stocks 🌐 are holding up the market. Don't miss our exclusive Cents Invest Club offerings and updates from the Twitterverse 🐦 to keep you informed and ahead in the world of finance 🌎.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

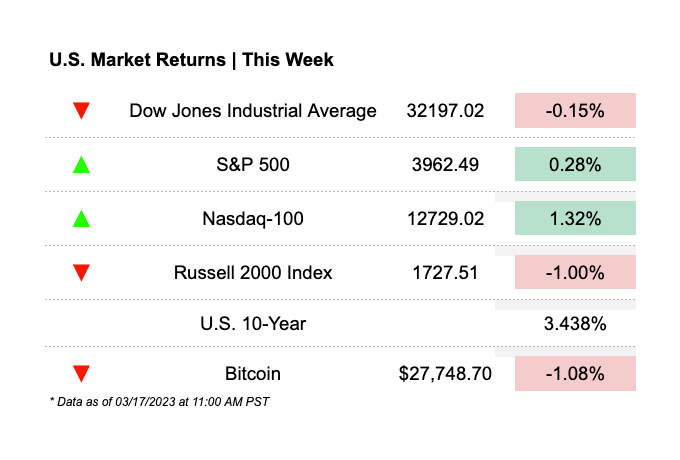

Mega Cap Tech is holding up the market.

Over the past 10 sessions, the GS Basket of Mega Cap Tech stocks is up +6.3%, while the RTY is down -10.5%.

This 16.8% performance spread is the 2nd highest of all time.

$QQQ $RTY $AAPL $MSFT $GOOG

— David Marlin (@Marlin_Capital)

4:18 PM • Mar 19, 2023

I had dinner with Charlie Munger.

I spent over 3 hours with him.

I got to see his library. I could ask him any question I wanted.

At 99 he is still *ferociously* intelligent.

The most important lesson I learned from him that night was: GO FOR GREAT.

In typical Charlie… twitter.com/i/web/status/1…

— David Senra (@FoundersPodcast)

4:54 PM • Mar 21, 2023

I’ve been playing with Google Bard for a while today and I never thought I’d say this, but… Bing is way ahead of Google right now (at this specific chat feature)

— Marques Brownlee (@MKBHD)

12:38 AM • Mar 22, 2023

we are starting our rollout of ChatGPT plugins.

you can install plugins to help with a wide variety of tasks. we are excited to see what developers create!

openai.com/blog/chatgpt-p…

— Sam Altman (@sama)

5:12 PM • Mar 23, 2023

Trends In Focus

With over 50% of their revenue generated from wealth management, the company has demonstrated resilience and strength in a volatile market. Here's a brief overview of why Morgan Stanley is an attractive investment:

Impressive ROTCE Growth

Diversified Revenue Streams

Low Net Interest Income Exposure

Strong Wealth and Investment Management

Impressive Deposit Growth

Robust CET1 Ratio

Unwarranted Share Price Decline

Capital Return and Deployment

In conclusion, Morgan Stanley presents a unique investment opportunity with its diversified revenue streams, solid wealth management growth, and strong capital position.

To read the full in depth write up click here.

Grupo Aeroportuario del Pacífico (PAC) is set to propose a dividend declaration and share repurchase program during its April 13, 2023, shareholder meeting. The proposed dividend, sourced from the retained earnings account, amounts to Ps. 11,685,291,653.00, with each class B share outstanding receiving Ps. 14.84 per share. The estimated dividend for American Depositary Share (ADS) holders is approximately USD$7.99 per ADS, based on the current exchange rate, representing a 4.4% yield based on the current price.

Additionally, PAC plans to cancel the outstanding balance under the previous Share Repurchase Program and allocate Ps. 2,500,000,000.00 for repurchasing shares within the next 12 months. The buyback authorization represents roughly 1.4% of the company's market capitalization. Combining both the dividend and buyback program, the estimated shareholder yield for the upcoming year is approximately 5.8%.

As a reminder, Pacifico airports bases their dividend off the prior year earnings, and is variable.

Cents Invest Club

Interesting Posts

Streams and Videos

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

🔵 Cents Invest Portal

🔵 Big Board (Club Portfolio)

🔵 Weekly Private ICOM Streams with the Team

🔵 Write-ups, Models, Notes, & More

🔵 Finance Training (DCFs, Comparable Analysis)

Disclosure: This post and its attachments are not financial advice. Might buy or sell any securities without disclosures. Please see full disclaimer here - https://centsinvest.com/spaces/9331277/page