- Cents Invest Newsletter

- Posts

- INTERESTING COMPANIES FOR 2023🤔

INTERESTING COMPANIES FOR 2023🤔

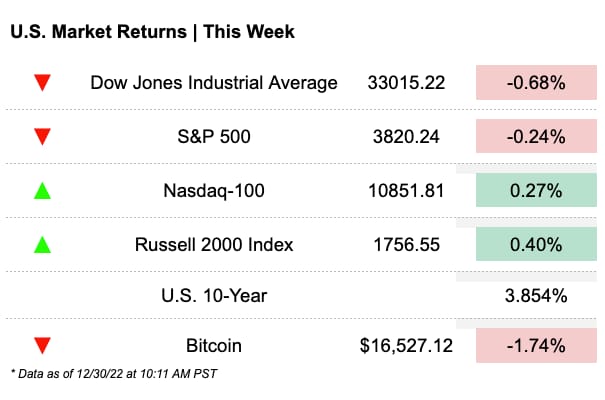

Week of 12/30/22

Happy Friday! 🥳

For all your ROIC-OG members the Mini-Board is BACK! Every Cents Invest Club member can find this under the Analyst Lists tab, this is basically a quick point to check if we have looked at a stock and what the quick take was. Expect this to be updated once or twice a week.

We hope you guys are enjoying the new newsletter! We are excited about the future as we believe we have the right analysts and staff in place to be able to maintain the best content and community possible. We will continue to make small changes to enhance your experience going into the next year.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE!

What You Need to Know

Headlines

On Twitter

I tend to be more of a bottoms up analyst but 2023 should prove to be a year of a battle of two narratives. Rates and inflation on one hand versus GDP growth, margins and ultimately earnings on the other. Markets will be further determined by participant's outlook from current...

— Daniel S. Loeb (@DanielSLoeb1)

1:54 PM • Dec 26, 2022

Don’t let how you invest today become your identity. It will stop/slow you down from evolving. You are no where near the best investor you can be.

— Ian Cassel (@iancassel)

2:25 PM • Dec 24, 2022

BofA: 10 Key Themes From Strategy & Macro for 2023

« Nibble at $SPY at 3600, bite at 3300 and gorge at 3000. » http

— Q-Cap (@qcapital2020)

12:44 PM • Dec 29, 2022

Investing is a delicate balance between

Mkts are pretty damn efficient most of the time

When you think the market has it wrong swing (and occasionally swing big)

You don’t need to make it back the same way you lost it

Never put yourself at risk of ruin because 0 x any # is 0

— 1 Main Capital (@1MainCapital)

9:44 PM • Dec 28, 2022

Trends In Focus

Weed companies are in a super tough environment right now, federally illegal so banking is impossible, because of this getting loans is difficult so their cost of capital is tough.

With weed stocks there are perhaps better alternatives to participate. One might desire to go deep value here, but keep in mind there maybe something underneath the surface.

Also consider the businesses that still benefit from their success but without the risks present in the operations. IIPR comes to mine as an example. Read more here.

TLT - In 2023 the Fed will end up being less hawkish and raising rates less then they are saying. With the lowering of rates you will see price appreciation in this equity.

CRWD - People don't understand how much ahead of all other companies CRWD is in their space and how much share they can take from the carcass of traditional malware security companies such as McAfee and Symantec.

DBRG - The executives are people who have been in the industry for 25 Years and all have a history with American Tower. They are moving into being essentially a private equity firm focused on investing in digital infrastructure alongside their investors similar to Brookfield Asset Management, which makes sense considering that BAM has invested into their funds in the last few months.

ROAD - This company is based in the Southeast US and focuses on repairs and maintenance of US infrastructure. They receive over 60% of their contracts from US States and Municipalities.

AMD - With semiconductors we are in a short term bear market within a long term structural bull market I anticipate weakness in Q4 numbers and guidance.

Read 12 more here

Cents Invest Club

Interesting Posts

Streams

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)