- Cents Invest Newsletter

- Posts

- INFLATION NOW AT 6 MONTH LOWS 💵

INFLATION NOW AT 6 MONTH LOWS 💵

Week of 1/13/23

💳 U.S. consumer borrowing exceeded expectations in December, driven by higher credit card balances. 🌍 European stocks have been performing better than their U.S. counterparts. 💸 Inflation in the U.S. slowed for the sixth straight month in December, 🏎️ while Tesla lowered prices on all models sold in the U.S.

REMINDER: Our investing club prides itself on using real valuations and real analysis to make informed investment decisions. We believe that by using solid data, we can help our members make smart investments that will lead to long-term financial success. Our team of experts closely monitors the market and uses a variety of tools to help identify undervalued opportunities. Join our club today and experience the difference that real metrics and real analysis can make in your investment portfolio!

📣 If you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE!

What You Need to Know

Headlines

On Twitter

There are some dirt cheap well run building products companies out there right now. Clearly you have a huge risk of end market weakness with housing slumping but at some point these will be great buys.

Really need to feel our Q4/Q1 declines first.

$IBP, $ADEN, $BLDR

— Deep Sail Capital (@DeepSailCapital)

8:34 PM • Jan 6, 2023

In summary:

1.) Short Luna

2.) Long ExxonMobil

3.) Long USD

4.) Short FTT

5.) Short ARKK

6.) Long Natural Gas

7.) Short Meta

8.) Long Yield

9.) Short Coinbase

10.) Short Beyond Meat— TradingView (@tradingview)

8:29 PM • Dec 30, 2022

Hedge funds are aggressively shorting tech (again)

— Markets & Mayhem (@Mayhem4Markets)

1:28 AM • Jan 11, 2023

“One of the important things in stocks is that a stock does not know that you own it. You have all these feelings about it. You remember what you paid. You remember who told you about it and it doesn’t give a damn. It just sits there"

--- Warren Buffett

Lesson be open minded

— Charlie Munger Fans (@CharlieMunger00)

8:10 AM • Jan 11, 2023

Trends In Focus

Liquidity Crunch in 2022 leads to Demand Destruction in 2023. Labor market is lagging. Fed will be late to the game, safety assets can play a part here along side a equity focused portfolio.

Employment figures released in the private payrolls was better than expected. 235,000 in December and an upward revision of 182,000. Jobless claims came down to 204,000 which marks the lowest measure since Sept 2022. Looking at S&P Global data we however see a slightly different story. PMI data came crashing down largely at fault to China. Imports were estimated at a 25% decline and the Census's calculations actually came in around a drop of 24%. Read more here.

The US CPI report came in yesterday and was up 6.5% YoY which was in line with estimates. This shows also that Month over Month the CPI is down 0.1% (this would be an annualized rate of -1.2% inflation).

While this is good that inflation is coming down. The question needs to be asked, "why is it coming down?" Are we seeing demand destruction or just a reversion to the mean for a supply shock? If you take out rent inflation, then these numbers are much more drastically showing disinflation/deflation.

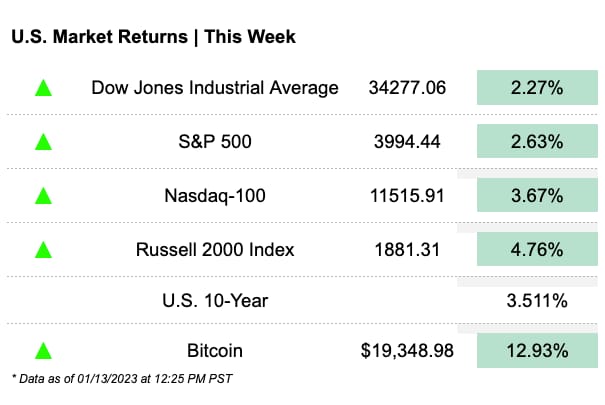

The US markets are rallied on this news as the idea is that if inflation is not persistent then the federal reserve will not need to continue to raise rates at the historically fast levels they have been. Read more here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)