- Cents Invest Newsletter

- Posts

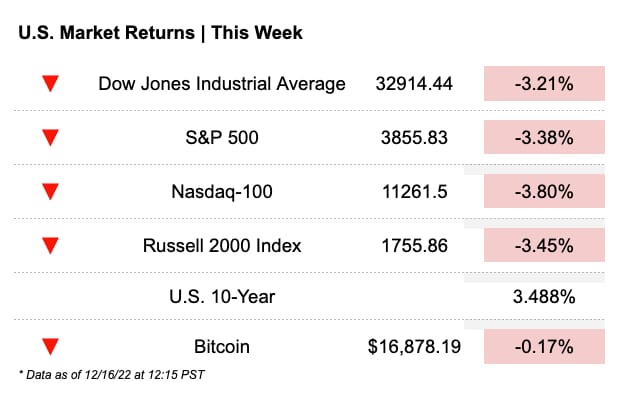

- THE FED TANKS THE MARKET

THE FED TANKS THE MARKET

Week of 12/16/2022

We are excited to be back in your inbox for your weekly round up of investing news, tweets, and trends. Cents Invest has been busy working on a HUGE revamp of the Cents Invest Club! You can read more here.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE!

What You Need to Know

Headlines

On Twitter

BofA released their end of year consumer checkpoint today. This chart sticks out - services spending appears to be holding up while retail spending falls off. Does this track with your own personal spending?

— Cents Invest (@CentsInvest)

4:59 PM • Dec 12, 2022

“Watch which asset classes they’re holding conferences for and how many people are attending. Sold out conferences are a danger sign. You want to participate in auctions where there are only one or two buyers, not hundreds or thousands”

--- Howard Marks

— Charlie Munger Fans (@CharlieMunger00)

8:08 PM • Dec 15, 2022

An overview of all tech layoffs in 2022:

— Compounding Quality (@QCompounding)

10:58 AM • Dec 15, 2022

Yesterday's $ADBE Q4 earnings call mentioned things like the resilience of Adobe, ChatGPT, and the Figma acquisition. In this thread we have curated our 11 favorite parts from the call 📝

1. "I have never been more certain that Adobe's best days are ahead", says Chairman & CEO: http

— Quartr (@Quartr_App)

12:37 PM • Dec 16, 2022

Trends In Focus

Currently, the macro-environment seems uncertain to many. The Fed seems to often change their tone, their dot plot and with less liquidity in the markets there are wild moves In each direction leaving investors confused as to what is happening and what will happen in the next year. While I am not a macro-environment expert, I thought by looking at what the bond market is doing in response to the Federal Reserve is sending a very loud signal as to what is going to happen in the upcoming year. Read more here.

Magellan, and of course pipeline companies in general, are remarkably stable businesses that play a key role (with pricing power) in our energy infrastructure, that have an (in the author's opinion) overpriced terminal value risk. Read more here.

Cents Invest Club

Interesting Posts

Streams

NEW STREAM SCHEDULE STARTS NEXT WEEK (Eastern Time)

Mondaze w/ the Cents Team (Public) - Monday 8:30 p.m.

Investing Q+A with Justin (Public) - Wednesday 8:30 p.m.

Investing Therapy w/ the Cents Team (Private) - Thursday 8:30 p.m.

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

✅ Cents Invest Portal

✅ Best Ideas Lists

✅ Active Discord Community

✅ Weekly Private ICOM Streams with the Team

✅ Write-ups, Models, Notes, & More

✅ Finance Training (DCFs, Comparable Analysis)