- Cents Invest Newsletter

- Posts

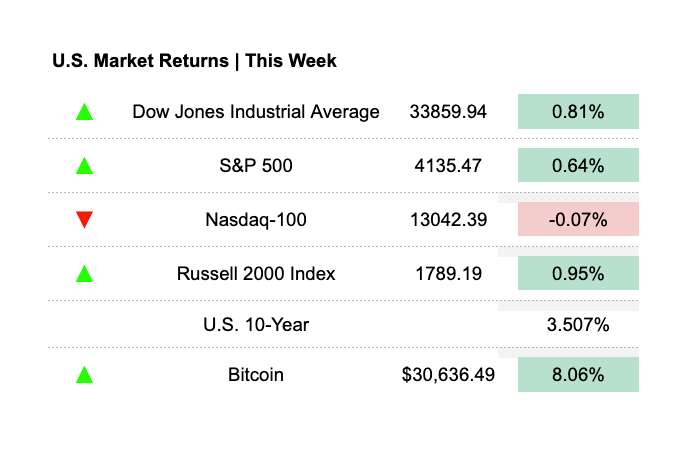

- Exploring Market Dynamics, Inflation, and Top Performers

Exploring Market Dynamics, Inflation, and Top Performers

Your Weekly Roundup of Essential Market News and Insights

📢 Welcome to this week's newsletter! 🗞️ Get ready for the latest insights on the financial world. 🌐 Discover March's job growth numbers 💼, the current state of U.S. inflation 📉, Warren Buffett's thoughts on bank failures 💥, supplier price changes 📊, ChatGPT's potential impact on stock predictions 🤖, and much more! 🎯 Don't miss out on key tweets 🐦 from finance experts, and our in-depth analysis on Perion Network Ltd. (PERI) 📈 and JPMorgan Chase's (JPM) stellar Q1 earnings 💰. Stay informed and ahead of the game! 🚀

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

History suggests that the worst of the market declines happen during the Recession.

Since 1929, around 2/3rds of the $SPX peak to trough drawdowns have occurred during, not before, US Recessions.

$SPY $QQQ $DJIA $AAPL

— David Marlin (@Marlin_Capital)

5:05 PM • Apr 7, 2023

Apple's, $AAPL, personal computer shipments fell by 40.5% in the first quarter, per Bloomberg.

— unusual_whales (@unusual_whales)

10:31 AM • Apr 11, 2023

Hedge funds have opened the largest short position in S&P500 index in over a decade.

Source: Bloomberg and COT http

— TIC TOC TIC (@TicTocTick)

4:57 PM • Apr 11, 2023

Haven't met one billionaire yet who reads the FOMC minutes. Don't waste your time focus on the gearbox and buying good businesses.

— Charlie Munger Fans (@CharlieMunger00)

6:11 PM • Apr 12, 2023

Trends In Focus

We want to discuss some concerns regarding Perion Network Ltd. that have led to a decision to reduce exposure to the stock. Over the past year, Perion has seen significant growth, partly due to its undervaluation and industry positioning. However, the stock now trades at around 14X free cash flow, transitioning from undervalued to fairly valued with potential risks. One of the factors contributing to Perion's stock price increase is the rise of Chat GPT, with the expectation that it will drive more revenue to Bing and, consequently, to Perion. However, the possibility of Perion losing the Bing contract has not been factored into the current price.

There have also been concerns surrounding management changes at Perion and the company's shift in direction from diversifying its revenue streams to focusing on its relationship with Bing. This strategy could make the investment riskier. Additionally, the company has not yet pre-announced its quarterly earnings, which may be a warning sign regarding their Q1 results.

Read the full write up here.

In a recent report from CNBC, JPMorgan Chase (JPM) announced its first quarter earnings for 2023, showcasing a strong financial performance. The banking giant has exceeded expectations, with a net income of $12.9 billion, or $4.23 per share. Analysts had anticipated earnings of $3.12 per share, demonstrating the company's impressive growth during the first quarter. JPMorgan Chase's revenues also rose to $33.1 billion, an increase of 8% compared to the same period last year. The bank's success can be attributed to its robust investment banking and trading divisions, which have flourished despite challenges in the market.

The CNBC report highlights that JPMorgan Chase's investment banking revenues climbed by 25%, reaching $3.6 billion in Q1 2023. This growth is credited to the strong performance of the bank's advisory services and debt underwriting, reflecting a thriving market for mergers and acquisitions. Additionally, the bank's trading revenues increased by 17% year-over-year, driven by the strong performance of the fixed income and equity markets. As JPMorgan Chase continues to surpass expectations, the bank's robust first quarter results provide a positive outlook for the remainder of 2023.

Read the full report here.

Cents Invest Club

Interesting Posts

Streams and Videos

*Exclusive Club Only Livestreams

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

🔵 Cents Invest Portal

🔵 Big Board (Club Portfolio)

🔵 Weekly Private ICOM Streams with the Team

🔵 Write-ups, Models, Notes, & More

🔵 Finance Training (DCFs, Comparable Analysis)

Disclosure: This post and its attachments are not financial advice. Might buy or sell any securities without disclosures. Please see full disclaimer here - https://centsinvest.com/spaces/9331277/page