- Cents Invest Newsletter

- Posts

- Banks & Tech: Rising Rates, Search Shakeups, and USB Analysis

Banks & Tech: Rising Rates, Search Shakeups, and USB Analysis

Interest Rates, Earnings, and Stock Highlights for Savvy Investors

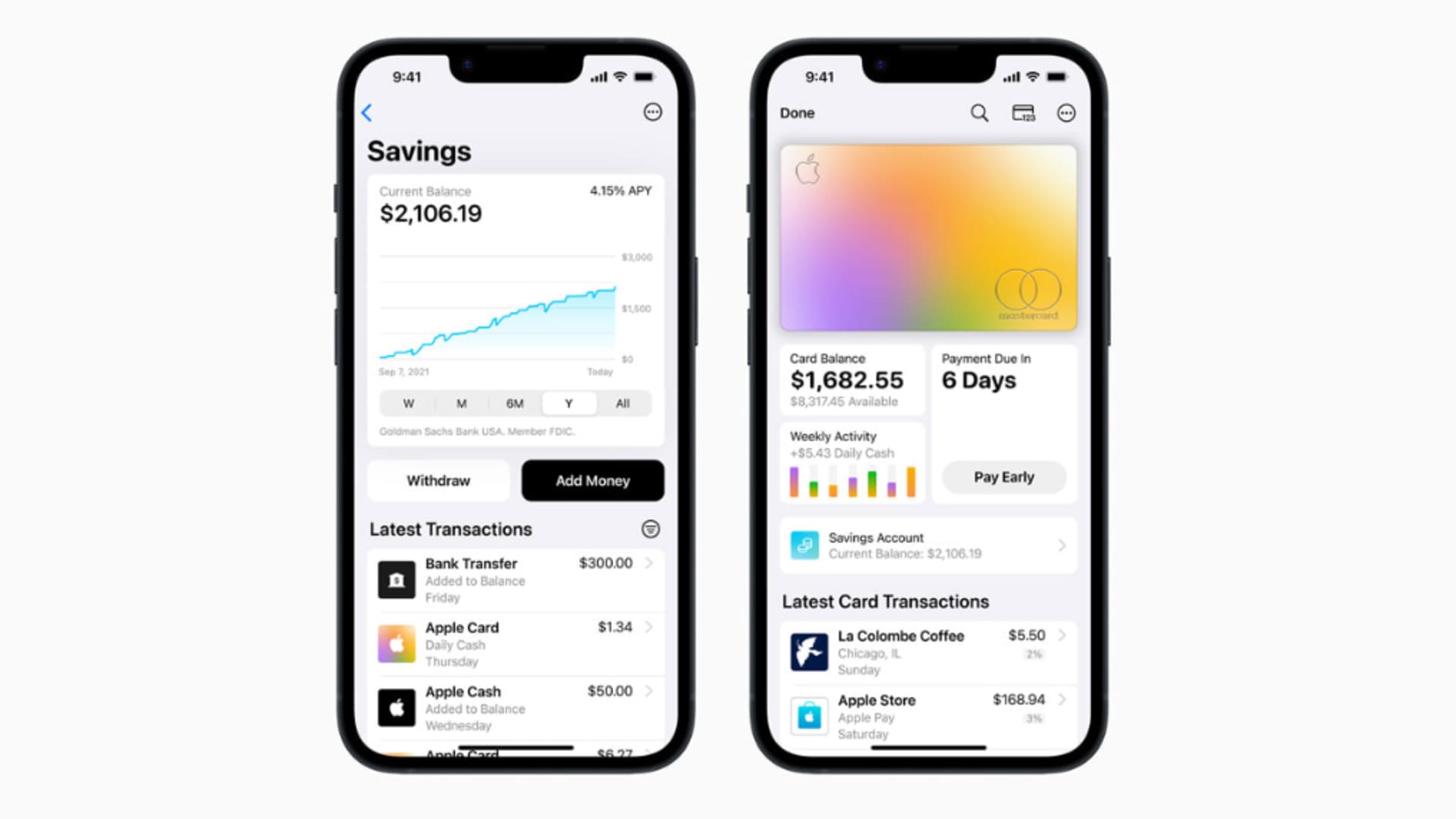

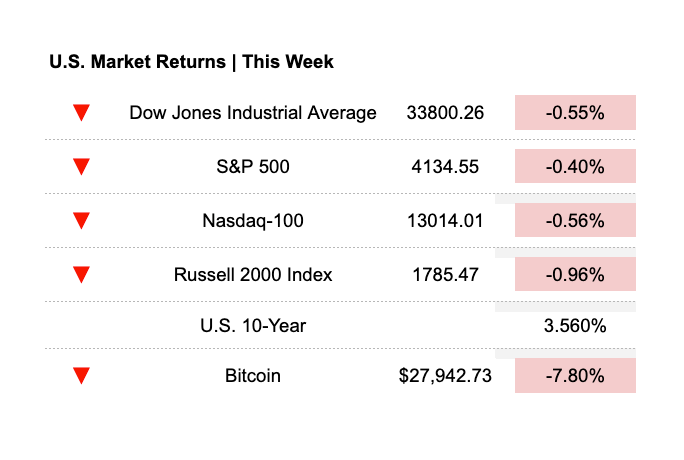

🚀 Welcome to this week's newsletter! 🌟 We've got important updates for you, including rising interest rates pressuring banks, Alphabet shares dipping due to Samsung possibly switching to Bing, Apple launching its savings account with a 4.15% interest rate, and Goldman Sachs missing revenue estimates after a $470 million hit on Marcus loans. 📉 Also, don't miss SpaceX's Starship explosion, Tesla's earnings decline, and tweets discussing NVDA, bond and equity markets, and Google's search engine market share. 🔍 Our featured stock analysis is on US Bancorp (USB), an American bank with an emphasis on liquidity and high ROE. 🏦 Exciting news for Cents Invest Club members: the Big Board has switched to real money this week! 💸 Make sure to check it out on the website.

📣 As a reminder, if you’re an accredited or serious investor looking for a community of serious intelligent stock investors head over to centsinvest.com and get 30 days FREE! 📣

What You Need to Know

Headlines

On Twitter

$NVDA it gets better, there are now no SELL rated analysts. EPS is up a whopping 6% over the last 2 mths while stock up 40% as the 43/13 Buy/Hold rated lemmings chased the stock higher lifting their targets from $200 to $280. EPS still ~30% below 12m ago when stock last at $300

— LostFundamentals (@LostFundamental)

2:06 PM • Apr 18, 2023

"Bond market pricing in recession; equity market pricing in AI." —Goldman Sachs

— JabroniCoin.USD (@TheBenSchmark)

8:22 PM • Apr 17, 2023

narrative violation: $GOOG gained search engine market share in Q1

— Portsea Capital (@portseacapital)

11:50 AM • Apr 20, 2023

Trends In Focus

US Bancorp is a prominent American bank with a focus on maintaining liquidity and boasting an average loan duration under 10 years, which mitigates risk. The bank has consistently delivered high returns on equity (ROE), outperforming most peers. Although exposure to office space loans presents a potential risk, US Bancorp has taken steps to reduce this, such as tightening underwriting standards and cutting exposure to specific types of loans. Its solid balance sheet and liquidity should further aid in weathering market turbulence. The bank provides attractive returns to shareholders through dividends and buybacks, with a dividend yield currently above 5%. Though buybacks may be muted in the short term, USB is considered a buy at current prices based on the ongoing market conditions and assumptions.

To read the full write up click here.

Cents Invest Club

Interesting Posts

Streams and Videos

Maximize your returns with a premium investing community for your portfolio and join the Cents Invest Club. Try 30 days FREE and get exclusive access to:

🔵 Cents Invest Portal

🔵 Big Board (Club Portfolio)

🔵 Weekly Private ICOM Streams with the Team

🔵 Write-ups, Models, Notes, & More

🔵 Finance Training (DCFs, Comparable Analysis)

Disclaimer: This post and its attachments are for educational purposes only. The information provided may not be accurate and is subject to change without notice. This post and its attachments do not constitute financial advice, and we do not recommend that you buy or sell any securities based on the information provided. Please be aware that the author of this post may buy or sell securities without disclosure. For more information, please refer to the full disclaimer on both the attachments and the website (https://centsinvest.com/spaces/9331277/page).